The financial markets are evolving, and automation is at the forefront of this change. For traders looking to gain an edge, ai powered trading bots represent a significant leap forward. Unlike basic automated systems, these bots use artificial intelligence to analyze data, predict trends, and execute trades with a level of sophistication that was once unimaginable. This guide explores how they work and what makes them so powerful.

Contents

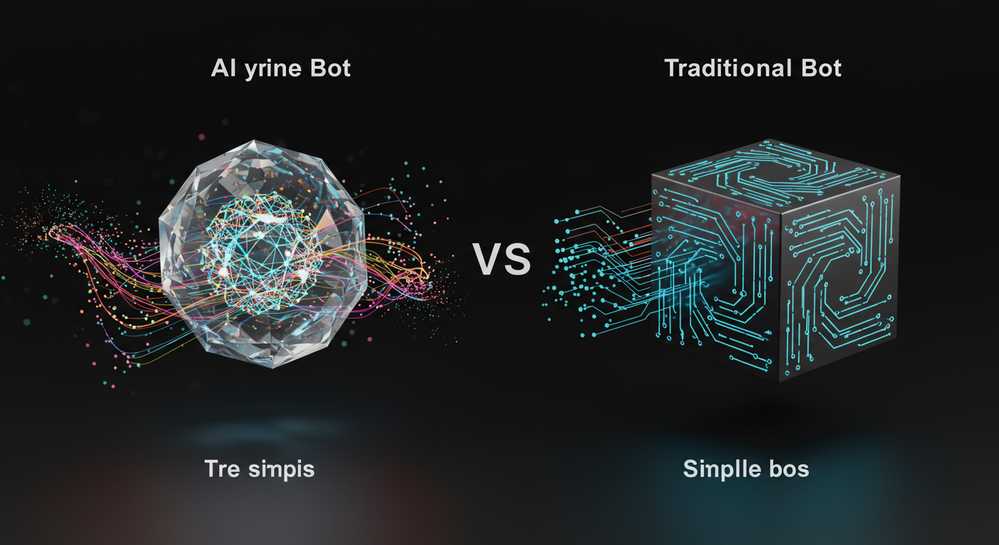

What distinguishes ai bots from traditional trading bots

An ai powered trading bot operates on a different level than a traditional, rule-based bot. The key distinction is its ability to learn and adapt, not just follow a predefined set of instructions. While both tools automate trading, their intelligence and operational methods are fundamentally different. Grasping this is the first step to leveraging their power effectively in 2025.

- Traditional bots use static strategies with fixed indicators like Moving Averages or RSI, requiring manual updates. AI bots dynamically adapt their strategy using machine learning on real-time market data.

- A standard bot processes limited quantitative data. An AI bot analyzes vast datasets, including news articles and social media sentiment, to make more informed decisions.

- Traditional bots are reactive, acting only after a condition is met. AI bots are predictive, forecasting potential market movements to act proactively.

How ai technology revolutionizes trading decisions

The intelligence of ai powered trading bots stems from sophisticated algorithms. These models mimic human analytical skills on a massive scale. They are not just executing commands but making informed, data-driven decisions. This is achieved by leveraging several key AI technologies that work together to interpret market signals.

Machine learning and pattern recognition

At the core of an AI bot is machine learning. The bot trains on vast amounts of historical market data, allowing it to recognize complex patterns invisible to the human eye. It identifies correlations between price movements, volume, and other indicators. As it processes new data, it refines its models, continuously improving performance and adapting to new market conditions without manual intervention.

Sentiment analysis with nlp

Many advanced AI bots integrate Natural Language Processing or NLP. This technology enables them to read and interpret human language from news, financial reports, and social media like X or Reddit. By analyzing sentiment from sources like the best crypto influencers list, the bot gauges market mood. This qualitative data allows for more nuanced and timely trading decisions.

The primary advantages and inherent risks of using ai bots

Integrating artificial intelligence into trading offers significant advantages but also carries inherent risks. A balanced perspective is crucial for leveraging ai powered trading bots effectively while protecting your capital. These tools are powerful assistants, not infallible oracles that can predict every market move.

Advantages of ai automation

- Speed and Efficiency: AI bots analyze markets and execute trades in milliseconds, capitalizing on opportunities faster than any human.

- 24/7 Operation: The crypto market never sleeps, and neither do bots. They monitor and trade around the clock, ensuring no opportunity is missed.

- Data-Driven Decisions: By removing human emotions like fear and greed, trades are based purely on data analysis and probability.

- Continuous Learning: The bots ability to learn from new data means strategies can evolve and remain effective as market dynamics shift.

Understanding the potential risks

- Market Volatility: No algorithm can predict black swan events or extreme market crashes. Over-reliance on a bot can lead to significant losses.

- Overfitting: A model might perform well on past data but fail in new market conditions. This highlights the importance of proper backtesting crypto bots.

- Technical Failures: Bots are susceptible to bugs, server downtime, or connectivity issues that could disrupt trading activity.

How to select an effective ai powered trading bot

Choosing the right ai powered trading bot is a critical decision that directly impacts your trading performance and security. Not all bots are created equal, and the best choice depends on your experience level, goals, and risk tolerance. Focus on objective criteria to make an informed decision and avoid platforms that overpromise.

- Security: Ensure the platform uses robust security measures, such as API key encryption and two-factor authentication (2FA), to protect your funds and data.

- Proven Track Record: Look for bots with transparent, verifiable performance histories. Backtesting results and real-world performance data are essential indicators of reliability.

- User Interface (UI): A clean, intuitive interface is crucial, especially for beginners. The platform should make it easy to configure the bot, monitor its performance, and intervene if necessary.

- Customization and Control: The ideal bot offers a balance between automated decision-making and user control. You should be able to set risk parameters, choose strategies, and define your own rules.

- Community and Support: A strong community and responsive customer support are invaluable resources for troubleshooting, learning, and sharing strategies.

While ai powered trading bots offer incredible potential for optimizing strategies and enhancing efficiency, they are not a guaranteed path to profits. Success depends on selecting a reliable platform and understanding the market. To explore cutting-edge automation tools, consider starting with a trusted provider like Best Sniper Bot. Their technology focuses on security and performance, providing a solid foundation for your automated trading journey.